AI is reshaping the MSP industry, what are the opportunities?

AI is reshaping the MSP industry, what are the opportunities?

Over the past few months, we’ve taken a deep dive into the Managed Service Provider (MSP) and Managed Security Service Provider (MSSP) landscape. The ongoing AI transformation of MSPs is a major opportunity for founders: AI tech is available, MSPs are eager to experiment, and pressure from private equities and market headwinds are accelerating adoption.

Below, we share our investment thesis, built on analysis of a broad range of start-ups and insights from over 50 conversations with founders and MSP operators. In addition, Fortino can leverage years of hands-on MSP experience through prior investments in Odin Groep and VanRoey.

MSPs and MSSPs manage IT and cybersecurity for SMBs and enterprises, performing tasks like IT infrastructure management, security and compliance and user support and helpdesk services.

The MSP and MSSP market is huge, about €200B in annual revenues in both EU and US, growing 10-15% p.a. [1,2,3]

Main growth drivers are:

- Increasing cloud adoption, only 30% of EU businesses have migrated the majority of their workloads to the cloud

- Rising cyber threats, driven by AI

- Growing demand from customers for support in adopting AI into their workflows

The market is highly fragmented, with +100,000 MSPs and MSSPs in the EU alone. Private Equity driven consolidation is ongoing, as investors appreciate the recurring nature of the revenues streams and see opportunities for economies of scale and expanded service offerings.

However, MSPs, particularly smaller ones, are suffering from deteriorating profit margins.

Main causes for margin pressure are:

- Bargaining power of large vendors e.g., Microsoft

- Increasing employee retention costs due to talent shortages

- Intensifying competitive pressure as MSPs struggle to differentiate, when most offer similar managed services, cloud applications and cybersecurity, predominantly tied to the Microsoft suite

- Rising client demands and expectations, especially in security and compliance standards

AI presents an opportunity and an existential risk: MSPs that adopt AI can reinvent themselves and grow, those don’t risk becoming uncompetitive.

Adopting AI is becoming essential for MSPs. Internally, AI enhances operations by accelerating tasks, increasing accuracy, reducing costs, and enabling 24/7 execution. Externally, it improves service delivery and unlocks new revenue streams. Larger MSPs already see AI services contributing significantly to revenue, for example, generative AI services generated $2.6B in revenue for Accenture in H1 2025 alone, while IBM Security brings AI capabilities to their customers via QRadar and Watson AI. SMB-focused MSPs are likely to follow.

MSPs that fail to adopt AI risk further margin erosion, declining service quality, and rising churn, even in a sector where churn has historically been low. For MSSPs, the urgency is greater: AI is accelerating cyber threats (cyber extortion attacks on SMBs grew 53% last year), and AI-native cybersecurity companies are bypassing MSSPs entirely by going directly to end customers.[4,5]

That said, AI won’t fully replace humans. Complex IT environments, coupled with the mission critical nature of IT and security, create the need for human oversight. Clients expect accountability and someone they can call in an emergency. The winning model will combine the speed and scale of AI with the judgement and reliability of experienced MSP operators.

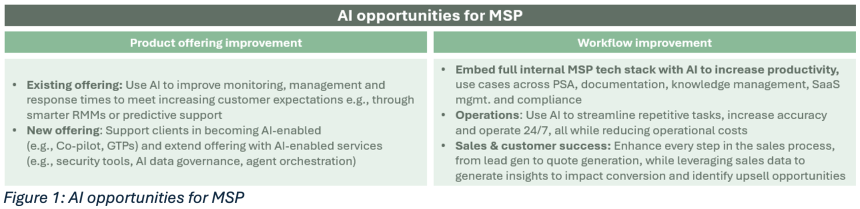

MSPs should leverage AI to enhance internal operations, improve customer delivery, and develop new offerings, but not all AI use cases are equally easy to adopt.

Adopting AI tools for workflow improvements, particularly in internal operations and sales, is usually straightforward, requiring limited internal capabilities but meaningful change management. The primary impact is on costs, boosting efficiency and significantly increasing output per FTE.

However, the product offering improvements outlined above will define the next generation of MSPs. Pax8 has coined a term for the evolution: MIP or “Managed Intelligence Providers”, MSPs that help clients implement and manage AI solutions across workflows while optimizing their usage and adoption.[6] However, MSPs won’t be able to compete across all AI domains: their best opportunities lie in offerings that are adjacent to their current services and overlap with existing core capabilities.

This shift to AI, both internally and in MSPs product offering, will require significant upskilling. MSPs will not only need to build technical expertise, but also strengthen commercial capabilities. AI adoption is a business decision for customers, driven by three goals: revenue growth, cost reduction, or risk mitigation. MSPs will need to understand where new use cases fit and how to sell them accordingly. Few MSPs have this experience today, and even fewer have mastered it.

This transformation may seem daunting, but it’s not the first time MSPs have needed to reinvent themselves. In the 2010s MSPs adopted cloud services and thrived; by 2015, they had added cyber security to their offerings with similar success. AI is the next wave.

SaaS for MSPs is dominated by a few large legacy players across different categories, but these incumbents are now being challenged by AI-native competitors.

Legacy MSP software suffers from low NPS and slow AI integration, opening the door for AI-native start-ups. While incumbents hold strong positions due to established distribution, customer lock-in, and rich datasets, their advantage is at risk if they fail to move quickly. We already see AI-native companies emerging, for example building smart interaction layers on top of legacy PSA and RMMs, with platforms like Kaseya and ConnectWise being reduced to the system of record.

Many founders are already building this AI-native next generation MSP tech stack; we made a non-exhaustive market map of EU and US based companies.

We see strong potential for start-ups providing workflow improvements to MSPs driven by relative ease of adoption, low AI capability requirements, and clear value add created by AI-native solutions. In product offering improvements, the biggest opportunities lie in areas where MSPs have a clear right to win and for solutions that can impact multiple buying criteria (revenue, cost and risk). Early success stories like Inforcer, Fixify and Vertice, each of which has raised more than €25M in recent months, highlight the strong momentum. We are confident many will follow.

Software solutions are not the only way to be successful in the future MSP landscape, some players are rebuilding the MSP model from the ground up, developing a best-in-class tooling and automation layer, then rolling up other MSPs and plugging them into the central tooling and automation layer to boost efficiency and margins. An example is Titan, which recently raised $74M from General Catalyst for an AI-enabled MSP roll-up.

We have been studying GTM motions of tech companies selling into MSP/MSSPs and these are some of the best practices and lessons learned.

Reach out if you are building in the space. We are excited to connect. There is no better time to start than now!

- AI tech is available and there is appetite by MSPs to test and innovate through AI

- PE is active in the space, they are known to be keen to leverage tech to optimize profit margins

- The space suffers from talent shortage and adoption of tech is a way to reduce dependence on human capital

Sources:

[1] https://www.mckinsey.com/capabilities/mckinsey-digital/our-insights/the-state-of-cloud-computing-in-europe-increasing-adoption-low-returns-huge-potential

[2] https://www.statista.com/outlook/tmo/it-services/europe

[3] https://www.statista.com/outlook/tmo/it-services/benelux

[4] https://www.orangecyberdefense.com/ch/news/orange-cyberdefense/security-navigator-2025-reveals-europe-as-top-target-for-hacktivism

[5] https://www.cobalt.io/blog/top-cybersecurity-statistics-2025

[6] https://www.produce8.com/resources/the-dawn-of-the-managed-intelligence-provider