Why we are excited about D2X

Why we are excited about D2X

D2X’s seed round marks our first VC investment in the blockchain space. We have been following the market for years and feel confident that the ecosystem’s infrastructure has progressed sufficiently to support significant business growth.

Blockchain adoption

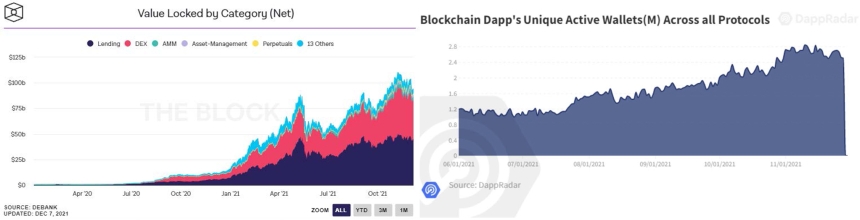

Similar to the ICO boom back in 2017, we are seeing increased levels of “hype” around potential blockchain use cases. Back then, many of those projects failed, turned out to be empty bags. This wasn’t necessarily because the use cases were poor. A major problem was that the infrastructure simply was not ready to turn those ideas into reality. Fast forward to today, one of the main shifts has been the increased maturity of core L1 & L2 infrastructure as well as the blockchain developer ecosystem as a whole. In other words, while we are again seeing increased levels of “hype”, today’s infrastructure can sustain/enable many of those ideas. This is visible, amongst others, in the growth of the DeFi space, and Unique Active Wallets (UAW) interacting with all sorts of protocols. The DeFi space currently holds roughly $100bn in total value locked (TVL). Furthermore, in November of 2021, we saw an average of ~2.5 million daily Unique Active Wallets (UAW) interacting across all protocols. The number looks even more impressive when compared to November 2020, as that average has increased 21,950% year-over-year (DappRadar).

With the proliferation of the blockchain ecosystem, institutional demand has picked up significantly. During a recent JP Morgan conference, Coinbase CEO, Brian Armstrong stated that over half of their $250bn crypto within their custody is institutional.

Derivatives for digital assets

The crypto derivatives space is especially interesting within that institutional uptick. We are in essence witnessing a once in a lifetime moment, namely the birth of a new asset class. During a recent CoinDesk-hosted panel discussion, Andrei Kazantsev, Goldman Sachs’ Global Head of Crypto Trading said, “We are seeing a lot of demand for more derivative-type hedging. The next big step that we are envisioning is the development of options markets.”

Similarly, in a recent interview with Cointelegraph, Luuk Strijers, CCO of the crypto options exchange Deribit said, “Large banks like Morgan Stanley, Citi and Goldman Sachs are starting to offer their clients a wide array of digital assets. However we don’t see them becoming active on offshore derivatives platforms yet. We do, however, see the tier-two firms in size, asset managers and hedge funds becoming more and more active… either actively investing/trading or alternatively hedging their VC investments”.

Bitcoin futures’ volume and open interest have exploded since the launch of the ProShares Bitcoin Strategy ETF, or BITO to about $25bn. Similarly, the open interest for Bitcoin options has surged to ~$12bn across crypto exchanges. This however pales in comparison to the overall derivatives market that is estimated to be over $1 quadrillion in size. Yes, you read that correctly, roughly 10x global GDP!

You may wonder why crypto derivative markets are so “small” relative to the overall derivatives market as well as the crypto spot market. There are several causes for this. For starters, most existing solutions are geared at retail investors and do not address the requirements of institutional investors. Moreover, the lack of liquidity and the absence of a pan-European regulated trading venue are major bottlenecks today.

D2X

D2X is addressing exactly those bottlenecks, with the goal to open the gates for institutional participation in the digital asset derivatives market. By aiming to deliver cash-settled (fiat-denominated) derivatives on digital assets, they are able to build a platform which doesn’t directly touch crypto. In other words, they don’t face any of the problems stemming from crypto custody, but more importantly, fall under the existing MiFID regulatory framework. This in turn opens up the possibility to apply for a multilateral trading facility (MTF) licence at one of the European financial regulators, such as the AFM, and passport it across Europe. This is a huge benefit, as currently, each European country has its own specific regulation which makes it an extreme challenge to provide European-wide regulated derivative exchange. The European Commission aims to streamline this with MiCA (new markets in crypto-assets), which is only rolling out in 2024.

“The EC’s proposal draws attention to cryptoasset companies’ inability to enjoy the benefits of Europe’s internal market for financial services due to a “lack of both legal certainty about the regulatory treatment of crypto-assets as well as the absence of a dedicated and coherent regulatory and supervisory regime at EU level. ” This is illustrated by the current inability for crypto firms to “passport” their licensing across the EU the way it is done in traditional financial services… The EC hopes to remedy this situation with MiCA.“

Beyond opening the gates to institutional demand for digital derivatives, D2X is also able to operate under a different legal structure from the large incumbent derivatives exchanges. This, paired with some clever thinking, opens up the opportunity to internalise and more importantly optimise the clearing, which can lead to significantly lower margin. But more on this as we move closer to the launch.

D2X founders Theodore and Don, got the idea while working at All Options, a derivatives trading firm, where they sought to take on the opportunity from within. They did, however, identify a lack of regulated trading facilities/institutional infrastructure and chose to address it front on by launching D2X. Laetitia further completes the founding team, bringing with her legal and regulatory blockchain knowledge as a former Linklaters lawyer and Natixis senior council blockchain specialist. The core team was subsequently strengthened with some heavy hitters in the industry, including (i) ex-head of PB & clearing of Societe Generale (ii) ex head of surveillance at Euronext and ex-head of risk at LCH.Clearnet (iii) and lastly the ex-CIO at Euronext and Clearstream.

Overall, the blockchain ecosystem is thriving; we are witnessing the birth of a new asset class; institutional demand is growing, but it is being stifled by a number of key bottlenecks that D2X is tackling in a clever way with a Tier 1 team.