SFDR Disclosures

SFDR Disclosures

The SFDR requires financial market participants such as Fortino Capital Partners (“Fortino”) to provide information to investors with regard to the integration of sustainability risks, the consideration of adverse sustainability impacts, the remuneration in relation to sustainability risks and the promotion of environmental or social characteristics, and sustainable investment.

You will find under Part I the Fortino AIFM level disclosures and under Part II the article 8 SFDR disclosures for the financial product Fortino Capital Growth PE II.

I. FORTINO AIFM LEVEL DISCLOSURES

The information below regarding the policies of Fortino on sustainability are made in accordance with articles 3, 4 and 5 of the SFDR (last updated in April 2023).

Integration of sustainability risk in the investment policies

In accordance with the SFDR, sustainability risk means an environmental, social or governance event or condition that, if it occurs, could cause an actual or potential material negative impact on the value of the investment. For Fortino, sustainability risks are risks which, if they were to crystallise, would cause a material negative impact on the value of the portfolio of its funds.

Fortino sees the integration of sustainability risk as the practice of incorporating material environmental, social, and governance (“ESG”) data and insights into investment decision-making, alongside traditional due diligence information, with the objective of improving the long-term value of the portfolio of its funds. Consideration of sustainability risk does not imply that a fund has a sustainable investment objective, but rather describes how sustainability risk is considered as part of the overall investment process.

The integration of sustainability risk in the investment process has been included as a principle in the ESG Policy (as included in the Integrity Policy and Code of Conduct) of Fortino Capital Partners. As such, sustainability risk has been included as a risk factor in the risk management policy of Fortino and a checking item in the risk checklist. In addition, prior to approving an investment by the Fund, the General Counsel of Fortino will sign off on the compliance checklist to confirm that appropriate ESG due diligence has been conducted and no red flag has been identified preventing the Fund to make the investment.

Fortino includes ESG information, where relevant or available in the (i) initial research and screening of an investment opportunity, (ii) due diligence in relation to a potential investment, (iii) investment committee and approval, and (iv) monitoring phases of the investment process. This includes thematic sustainability information sourced from trustworthy sources (such as UN reports in relation to sustainability) and the use of a proprietary ESG due diligence questionnaire to identify, analyse and document sustainability matters. This information is used by the investment committee when reviewing and approving an investment opportunity. Fortino considers sustainability criteria during post-investment monitoring and conducts regular portfolio risk reviews.

Integration of sustainability risk in the remuneration policy

The remuneration policy of Fortino Capital Partners takes into account compliance with its policies and procedures, including the ESG policy, and discourages excessive risk-taking among others in relation to sustainability risks.

Principal adverse impact of investment decisions on sustainability factors

Adverse sustainability impacts relate to the risk that the business of a portfolio company may have on sustainability indicators.

Fortino Capital Partners considers that the private equity industry can have a significant impact on a number of sustainability indicators in relation to the society and the environment. Fortino is of the opinion that the consideration that the business of an investee company may have an adverse impact on sustainability indicators should form part of the investment process. Therefore, Fortino has formalised its approach to assess investment opportunities against these potential adverse impacts. Fortino commits to consider certain potential adverse sustainability impacts without, at this point in time, considering all adverse sustainability impacts under the SFDR.

Therefore, in accordance with article 4.1(b) of the SFDR, Fortino Capital Partners states that it does not consider the adverse impacts of investment decisions on all of the sustainability factors as referred to in article 4.1(a) of the SFDR and does not make the disclosures as described in article 4.1(a) of the SFDR. Given the size of the organisation of Fortino, such disclosure as referred to in article 4.1(a) of the SFDR and the administrative burden in connection therewith would currently not be proportional. Fortino will review its position on a regular basis taking into account the evolution of the applicable rules and the results of the consideration of certain potential adverse sustainability impacts that it currently takes into account.

II. FORTINO CAPITAL GROWTH PE II ARTICLE 8 SFDR DISCLOSURES

Summary

Fortino Capital Growth PE II (the “Fund”) is a financial product that promotes environmental and/or social characteristics, but does not have as its objective sustainable investment and does not invest in sustainable investments. No reference benchmark has been designated for the purpose of attaining the environmental and/or social characteristics promoted by the Fund.

The Fund is generally oriented and promotes environmental and/or social characteristics in the sense that the Fund aims to invest in companies that grow responsible businesses, focus on having a sound governance and comply with minimum social and environmental safeguards, including those concerning labour rights, human rights, anti-bribery and environmental protection. "Responsible investment" is integrated in the investment process by taking measures in respect of investment screening, due diligence, monitoring and reporting.

No sustainable investment objective

This financial product promotes environmental and/or social characteristics, but does not have as its objective sustainable investment.

Environmental or social characteristics of the financial product

The Fund is generally oriented and promotes environmental and/or social characteristics in the sense that the Fund aims to invest in companies that grow responsible businesses, focus on having a sound governance and comply with minimum social and environmental safeguards, including those concerning labour rights, human rights, anti-bribery and environmental protection.

The General Partner (the “GP”) integrates “responsible investment” in its investment process by taking the following measures:

-

Investment screening – The Fund is restricted from investing in certain non-ethical businesses and investment opportunities are screened against a list of excluded regions, sectors and activities (exclusion list), which includes amongst other investments in weapons, palm oil value chain or deforestation, nuclear power plant, coil-fired power plant, mining industry, tobacco, gambling and child or forced labor. For every individual investment opportunity, the Fund and the GP look at the sector/industry in which the portfolio company operates.

-

Due diligence - As part of the due diligence with respect to a potential investment, the Fund and the GP take into account certain potential adverse sustainability impacts by using an ESG due diligence questionnaire. The questionnaire is a proprietary source of the GP which has been developed on the basis of the ‘Guide to ESG Due Diligence for Private Equity GPs and their Portfolio Companies’ published by Invest Europe. Environmental, social and governance criteria are analyzed as part of the due diligence process and will be taken into account in the investment decision. Criteria which are amongst others screened are the existence of an ESG policy and framework, environmental policy and management, labour rights, anti-bribery, discrimination and diversity and governance framework. When certain material adverse sustainability impacts are identified, they will be included in discussions with the Fortino investment committee and external advisors may be engaged to carry out additional (ESG-related) due diligence as needed.

-

Monitoring - The Fund and the GP take an active approach to manage ESG during ownership. Each portfolio company undertakes at the time of investment to adopt an ESG strategy within 12 months from the Fund’s initial investment date covering (i) the adoption of a climate policy, (ii) the adoption of a policy in terms of other environmental, social and corporate governance criteria, inter alia, gender, ethnicity and governance transparency, (iii) the implementation of measures to improve the company’s ESG impact, and (iv) the adoption of Fortino Standard Operating Principles with respect to board and reporting best practices. In addition, where material adverse sustainability impacts are identified during the due diligence process, they will be included in a 100-day or 365-day post-closing roadmap covering any aspect to be remedied / improved and which will be part of the investment documentation. Implementation of the roadmap by the portfolio company will be monitored by the investment team and the Fund's representative in the board of directors of the portfolio company concerned.

-

Reporting - Each portfolio company will provide a yearly ESG report to the Fund, no later than 90 days after the end of each calendar year. The GP has onboarded the Fund on a digital ESG reporting platform (KEY ESG) to assess and report on the ESG performance of each portfolio company in a streamlined manner. Reporting on the Fund's investments will also be made in accordance with Annex IV to the Regulatory Technical Standards of the SFDR.

Below is a selection of sustainability indicators assessed or that will be assessed as part of the investment or monitoring process. The indicators are split between 3 themes.

Environment

-

Carbon footprint (including energy consumption, , water & waste management, etc.)

-

Greenhouse gas (GHG) emission

-

Exposure to companies active in the fossil fuel sector

Social

-

Headcount and net job creation

-

Violations of UN Global Compact principles and Organisation for Economic Cooperation and Development (OECD) Guidelines for Multinational Enterprises

-

Exposure to controversial weapons

-

Diversity and inclusion

-

Health and safety

-

Trainings provided to employees

-

Compensation and benefits

Governance

-

Board gender diversity and management body gender diversity Board independence

-

ESG policy, ESG manager, ESG risks and ESG certifications

-

Anti-corruption policy

-

Excessive CEO pay ratio

-

Customer satisfaction

-

IT governance

Investment strategy

The Fund helps uncover and enable all the right factors for established companies and entrepreneurs to grow. The Fund typically deploys between €5-30M initial equity investment in established private companies with the following characteristics: clear product-market fit, minimum turnover €5M-10M, profitable in the core, B2B SaaS and PaaS applications, minority and majority stakes, headquartered or doing business in North-Western Europe.

When assessing an investment opportunity, ESG forms an integral part of the due diligence process. This ensures that the minimum ESG safeguards will be taken into account into the decision to invest. ESG issues are assessed based on their financial materiality and the likelihood and scale of any adverse sustainability impact. In addition, the Fund and the GP will assess good governance practices of potential investments as part of the ESG due diligence questionnaire but also through the legal due diligence which covers many governance-related topics (such as corporate governance, books and records, appropriate permits and licenses, appropriate contracts, etc.).

Furthermore, the GP has developed Fortino’s Standard Operating Principles (FSOPs) on good governance which are used after a Portfolio Company has been acquired to ensure a high quality of governance among the Fund’s portfolio company. The portfolio company will also commit as part of the transaction documentation to adopt the FSOPs with respect to board and reporting best practices, covering a broad variety of topics such as board composition, diversity, remuneration policy, board dynamics, financial and non-financial reporting KPIs, maintenance of database, etc.

Proportion of investments

The Fund will allocate 100% of its assets to non-listed SMEs, and/or Small Mid-Caps, and/or Mid-Caps growth technology companies, such as (but not limited to) software companies and companies embracing new software applications and digital tools such as artificial intelligence, virtual and augmented reality, medtech, internet of things, robotics and blockchain.

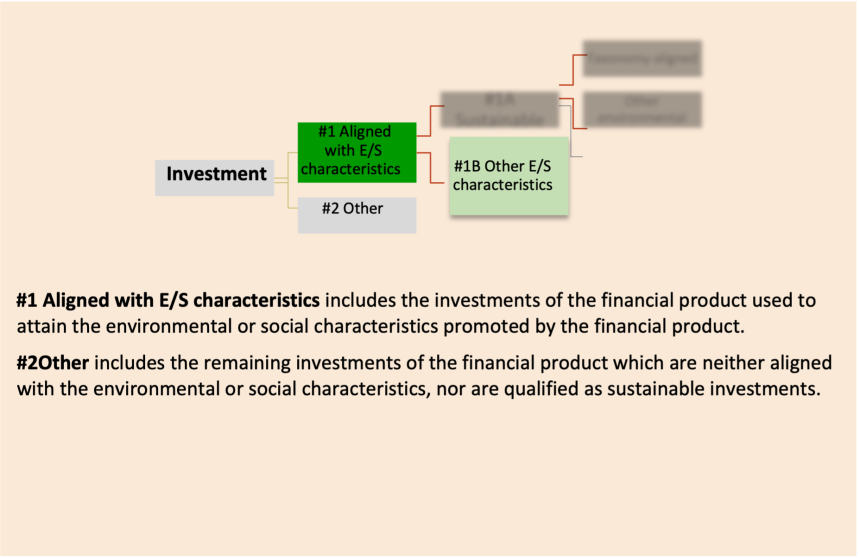

All investments of the Fund can be categorized as “#1 Aligned with E/S characteristics”. None of the Fund’s investments are included under “#2 Other”.

Monitoring of environmental or social characteristics

The environmental and social characteristics of the portfolio companies will be monitored throughout the lifecycle of the Fund via the yearly reporting to be made by the portfolio companies. Each portfolio company will provide a yearly ESG report to the Fund, no later than 90 days after the end of each calendar year. The GP has onboarded the Fund on a digital ESG reporting platform (KEY ESG) to assess and report on the ESG performance of each portfolio company in a streamlined manner. Reporting on the Fund's investments will also be made in accordance with Annex IV to the Regulatory Technical Standards of the SFDR.

The Fund and the GP take an active approach to manage ESG during ownership. Each portfolio company undertakes at the time of the investment to adopt an ESG strategy within 12 months and its implementation will be regularly monitored by the Fund's representative in the board of directors of the portfolio company concerned.

Methodologies for environmental or social characteristics

The ESG reporting tool, KEY ESG, ensures process efficiency and data accuracy through digitalization. This allows the portfolio companies to use one consolidated and automated system for ESG data that is easily shared and exported.

This methodology will drive value creation as:

-

the portfolio companies can easily understand Fortino’s expectations, visualize their own progress and opportunities, to further enhance their sustainability journey;

-

it improves stakeholder communications through the capacity to systematically gather and calculate quantifiable and meaningful data for external sustainability reporting and other corporate purposes;

-

it facilitates smoother decision-making with increased insights of opportunities and threats, including managing sustainability risks;

-

it improves the quality of the data reported by the portfolio companies.

Data sources and processing

We will use the data provided by the portfolio companies through the ESG due diligence questionnaire and the yearly (financial and ESG) reporting. The data will be automatically processed via the Key ESG platform and each portfolio company will be provided with a yearly report visualising their individual ESG performance.

The GP aimed to strike the right balance between essential ESG data and the compliance burden of the portfolio companies. The first ESG reporting campaign, conducted in FY 2023, encompassed 153 ESG indicators, which may be reviewed from time to time.

Limitations to methodologies and data

The limitations to methodologies and data sources will be regularly monitored, assessed and disclosed accordingly, so that they do not affect how the environmental and/or social characteristics promoted by the Fund are met.

Due diligence

Please refer to the Section "Environmental or social characteristics of the financial product" above.

Engagement policies

The Fund and the GP take an active approach to manage ESG during ownership. Each portfolio company undertakes at the time of the investment to adopt an ESG strategy within 12 months from the Fund’s initial investment date covering (i) the adoption of a climate policy, (ii) the adoption of a policy in terms of other environmental, social and corporate governance criteria, inter alia, gender, ethnicity and governance transparency, (iii) the implementation of measures to improve the company’s ESG impact, and (iv) the adoption Fortino Standard Operating Principles with respect to board and reporting best practices.

Designated reference benchmark

Not applicable, as no specific index has been designated as a reference benchmark to meet the environmental and/or social characteristics promoted by the Fund.

Are you a B2B software company raising

funds? You're in the right place, use this form

to pitch us!

Are you reaching out to us about business

development, collaboration or media

relations? Perfect, email us!