How to become a unicorn?

How to become a unicorn?

Becoming a unicorn – a major ambition for many investors and entrepreneurs, but do you know what it takes for a start-up to actually reach that USD 1 Billion valuation?

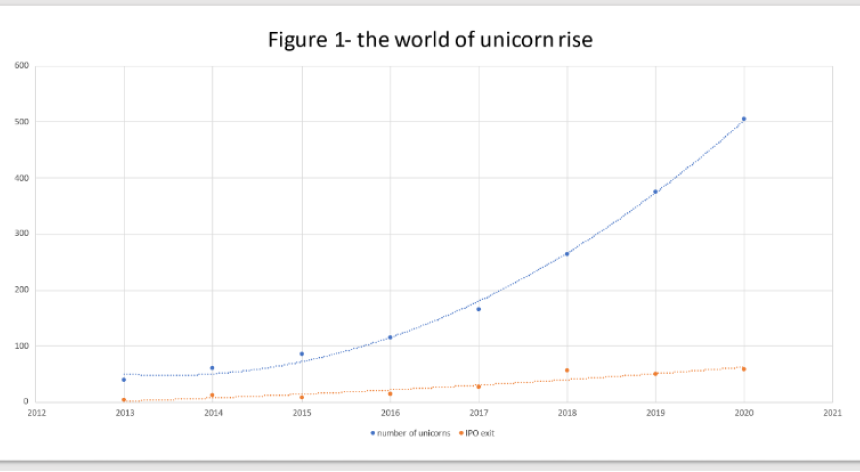

In 2013, when Aileen Lee, the founding partner at Cowboy Ventures, first coined the term “unicorn”, the club was an exclusive one. Today, however, there are about one thousand of them. And while this larger pool may suggest that the criteria to becoming a unicorn has evolved, the pool itself gives us a unique opportunity to deliver a more representative, data-driven view of how to become one.

In this article, we use that data to show you all you need to know about what unicorns do differently to other start-ups – and how to possibly become one.

Unicorns back then

Figure 1 shows that the number of unicorns has grown by 50% annually since the term first emerged in 2013, when Aileen (among others) laid out a series of common features to the 40 “original” unicorns:

- B2C - Consumer-oriented unicorns ruled by 2013, even if B2B delivered a higher return on private investment.

- Duration - On average, it took more than seven years to reach the unicorn valuation. It implies that a start-up initially worth 10 million had to double in valuation every year.

- Experienced team - Companies with highly qualified teams were most successful.

- Focused journey - Most unicorns stuck to the product first. The business model and product solved an important question upfront, for a large market.

- San Francisco - The main home of unicorns.

Five updated observations on unicorns’ success

The one issue with Aileen’s list is that it is more about shared features. The success factors may not necessarily separate unicorns from other companies. Furthermore, the pool of unicorns was limited, with less than 50 of them at the time. The greater number of unicorns today provides not only a reason to update these factors for success, but also an extensive data set to run a machine learning-based classification between unicorns and other companies.

The analysis points to the 5 following essential insights:

1. The value “Top 10” list and the critical importance of scaling

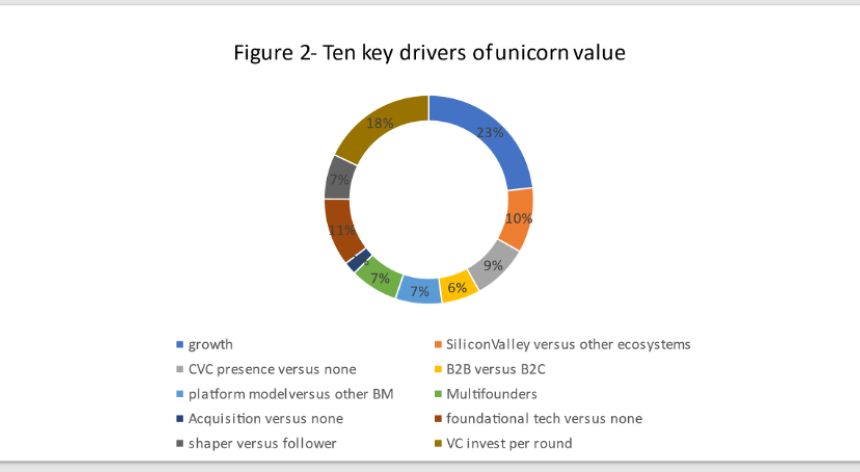

Figure 2 gathers the success factors with their relative importance to unicorn value. As such, this list confirms some of the Aileen’s original findings, such as the role of Silicon Valley or the presence of multiple founders. But our research adds more, such as the importance of first movers and leveraging foundational tech. It also runs contrary to early beliefs that unicorns arise more frequently from B2C.

In general, the highest correlated factor to value is a start-up’s ability to scale (25% of the variance).

2. The two faces of a unicorn

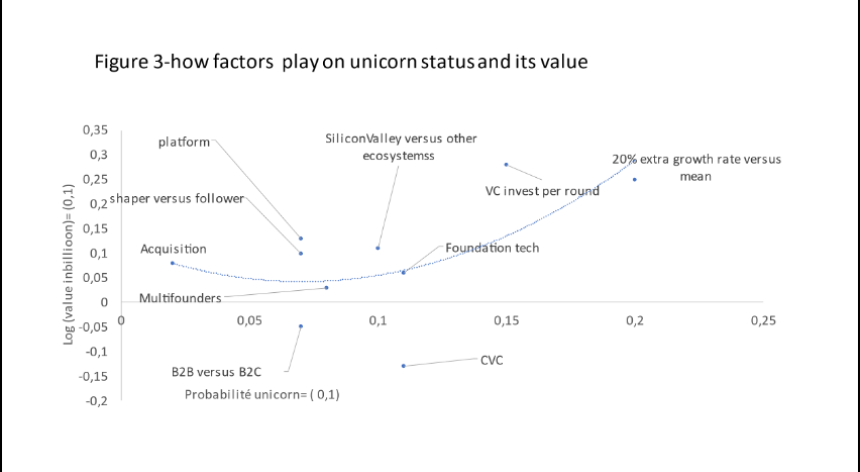

A valuable unicorn is the product of reaching unicorn status and of boosting its value as a unicorn. Figure 3 plots the 10 factors in the space (0,1), with the best case (1,1) is a decacorn, with two key observations:

- Double wins: The factors in the “Top 10” list both increase the likelihood of reaching unicorn status and of boosting the value of a unicorn. The exceptions that confirm the rule are that B2B and Corporate VC presence tend to deplete the unicorn’s value.

- Acceleration: Except for the use of foundational tech and the presence of multiple founders, the “Top 10” list also accelerates value on top of the probability of becoming a unicorn.

3. The recipe to unicorn status: Same as for start-up success, but more intense

Looking at the horizontal axis of figure 3 and combining the factors, we can see that the recipe for becoming a unicorn is 30% team (experienced team) and 39% finance-related (VC round), with the balance made up by the business model/scaling (growth, platform business model, etc).

Note that this recipe is no different to any other start-up’s. The difference is in its intensity. The team must not only have the chemistry to make the start up last, but in the case of a unicorn, the team has to demonstrate the ability to sustain the momentum of growth (“scaling”). In general, the best leadership teams need to be experienced, as this is a difficult pace to master the first time around.

We also discover that entrepreneurial financing has to be broad, and that Corporate VC financing can be a source of success, as it demonstrates a broader scope of possible exits. Finally, the business models need to be scalable and innovative.

4. Exponential revenue growth

What also makes unicorns different from other start-ups is their scale of growth. Double-digit revenue growth might not seem to be enough. Research shows that the typical, median growth for surviving start-up companies is about 50%, with a 70% growth rate in their third year.

A company growing at about 70% for at least 7 years, however, only has a 1 in 5 chance of becoming a unicorn. For another company growing at 100% per year – in other words doubling every year – these chances increase to 1 in 2, or 50%, all other things remaining equal.

It is also worth pointing out that this rate of growth cannot be achieved in a single, local market, except if that local Total Addressable Market is larger than USD 10 Billion. In general, 90% of unicorn companies have globalised quickly, reaching multiple markets at once. For a significant number of unicorns, the revenue share from their domestic market already made up 50% of their revenue.

5. Boosting the value of unicorn: Early, disruptive, and scalable models

Using again the vertical axis in Figure 3, the analysis shows that value creation, as a unicorn, depends on early, disruptive, and scalable business models:

- Business model: Platform B2B is a better bet for becoming a unicorn. In general, the belief was that B2C would be a better bet, but, in fact, B2B has emerged as a better bet, at least to reach unicorn status.

- First-movers: It is better to shape a market and move first, and a way to sustain this is to leverage acquisition on top of organic growth.

- New tech: It pays to play on foundational disruption – e.g. most unicorns have tended to surf the rise of major, disruptive trends, such as social connectivity for Facebook and LinkedIn, the shift to data analytics for Palantir, the boost in gig and mobility economy for Uber, etc., while leveraging strong, recurrent business models such as SaaS.

Wrapping it up…

Machine learning has allowed us to update the unicorn story by helping us isolate the most important factors in becoming one. And the story that emerges is that are successful start-ups that increase the INTENSITY at three levels:

1. Hyper scaling

Unicorns are able to maintain the same, exponential growth momentum as in their early years and enable themselves to grow with acquisitions.

2. Their metabolic rate

Unicorns are the first movers in their market with the support of – and by leveraging – foundational technology.

3. Their extended partnership play

Unicorns have a more experienced internal team, mirrored by enough VC support and external funding.

Of course, it remains obvious that most start-ups will not become unicorns. But getting these three levels right will help maximise the hopes of those who want to achieve that status, not to mention a rich portfolio of start-up survivors.

If you’re a Europe-based B2B SaaS company looking for advice and potential investment, we can help. Get in touch, and let’s get the conversation started.

Article by Jacques Bughin (Professor Management at Solvay Brussels School Economics and Management and Senior Advisor at Fortino Capital and Antler) and Marcel van der Heijden (Partner at Fortino Capital).