State of European Tech 2022: our top 6 takeaways

State of European Tech 2022: our top 6 takeaways

The new State of European Tech 2022 report by Atomico and partners is out and we have summarized our top 6 takeaways.

1. Founders look for VCs as reliable partners with tangible value add

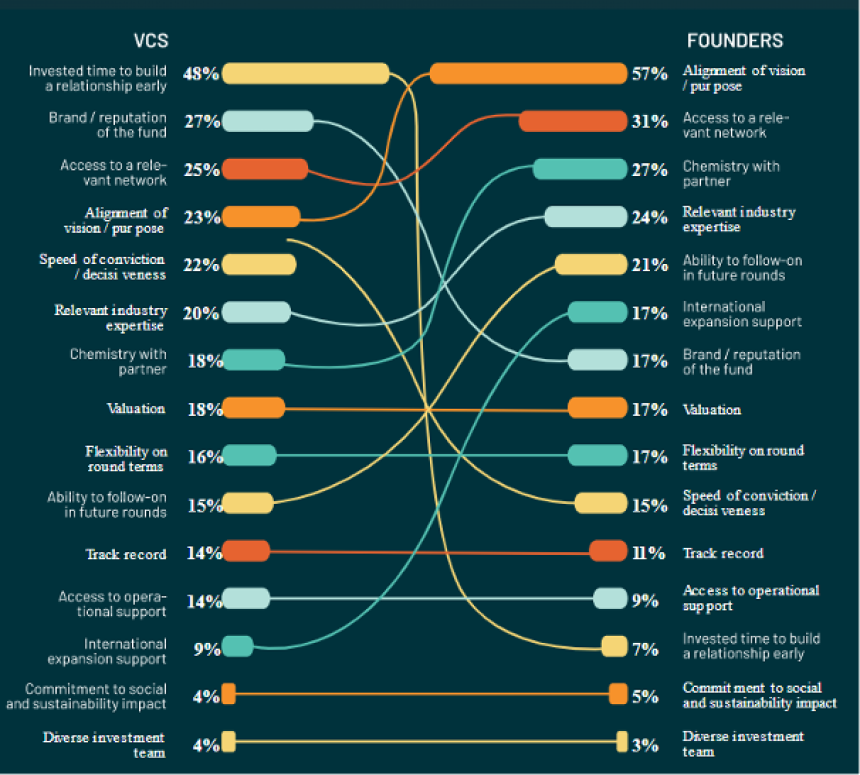

Atomico asked founders what their most important considerations were when selecting an investor to lead their next round; they also asked VCs what they thought allowed them to win competitive deals this past year. The results were quite different.

Founders are looking for a reliable business partner that understands the business they are building and can provide tangible value add.

Contrary to Founders, VCs value early relationship building, as this enables them to track how a company develops over time and as way to maintain the option to invest in future funding rounds.

2. Business development & Sales as key differentiator for VCs

Business development and Sales are areas that could be a key differentiator for VCs executing well against them, given they are high in demand and some of the areas with the greatest level of dissatisfaction from founders. Both of these are also likely to grow in importance as companies look to grow and/or defend their revenue base during a period of economic pressure.

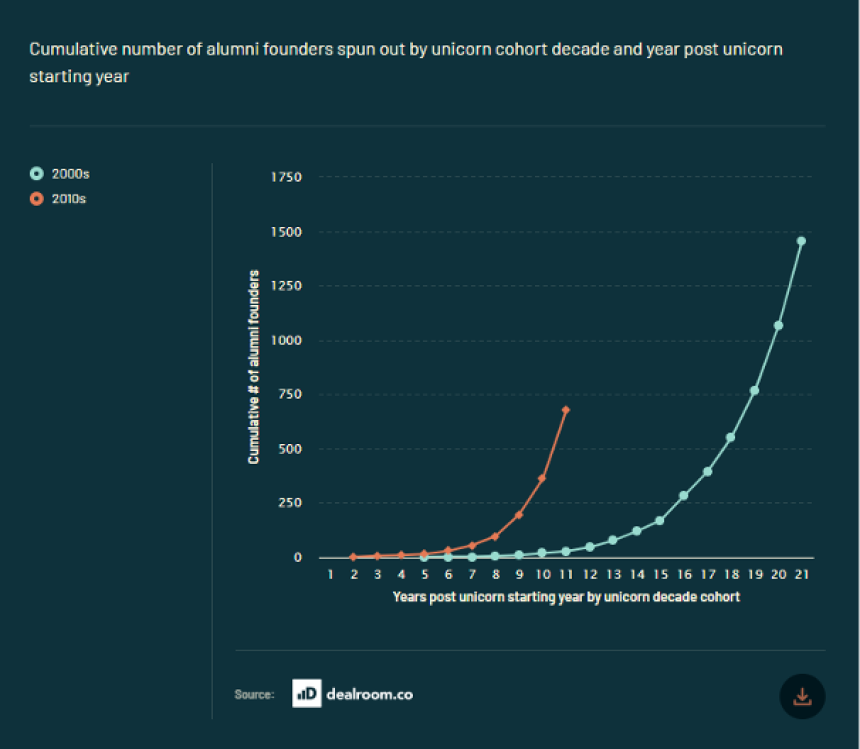

3. Europe’s tech talent flywheel picks up speed

Europe has now seen the emergence of almost 1,500 founders that went on to start their own companies after working for a European unicorn founded during the 2000s.

Comparing “alumni” from unicorns founded in the 2000s to those founded in the 2010s, it's clear that the flywheel is picking up speed. Today, the 2010s cohort has led to almost 700 identifiable founders – almost 25x the amount from the 2000s cohort at the equivalent point in time.

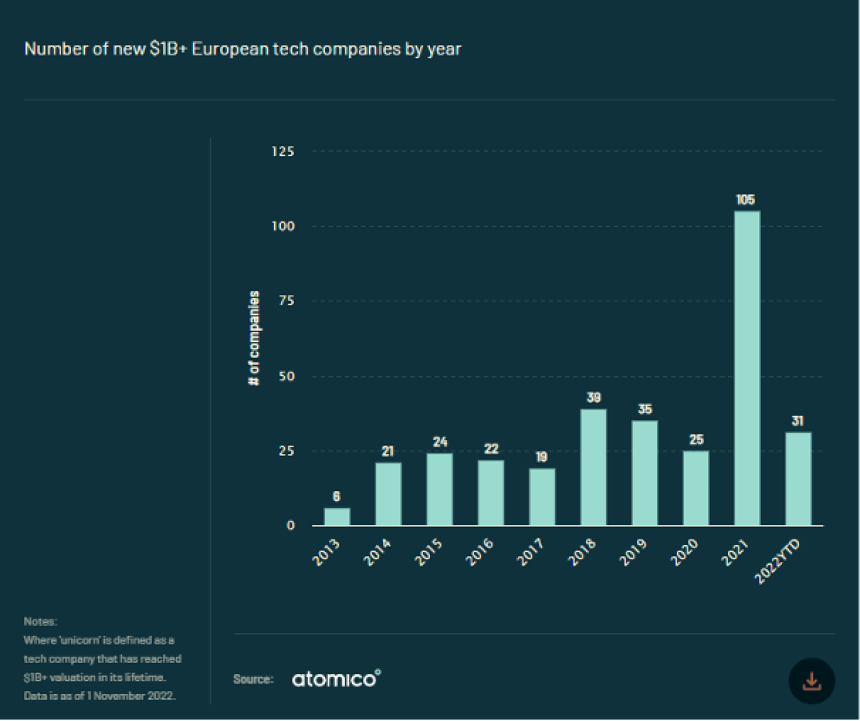

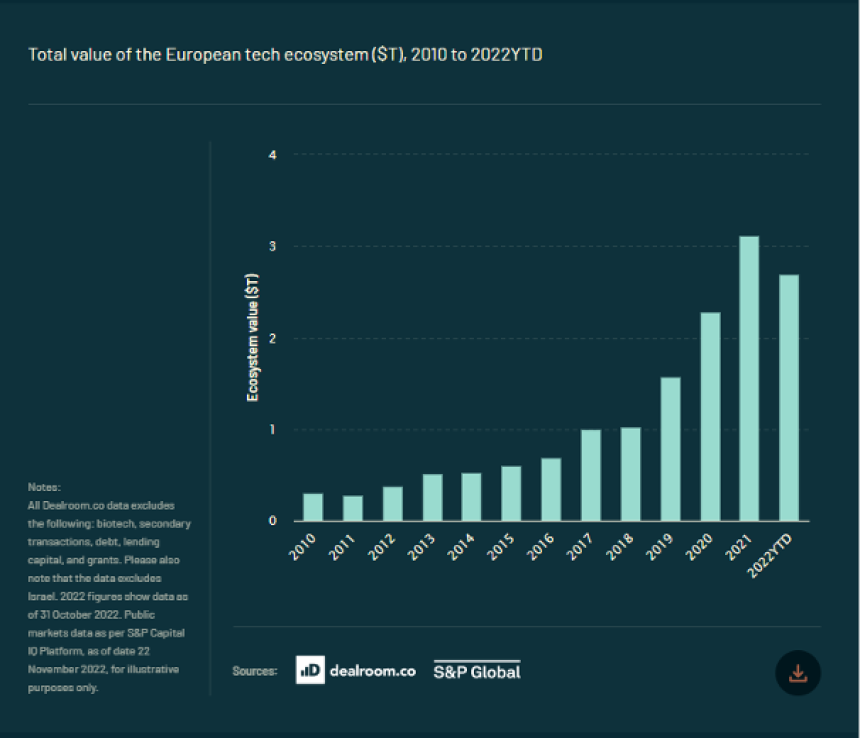

4. $400 billion in value “erased”

European tech companies across both the public and private markets saw roughly $400 billion of value erased over the last 12 months. On a positive note, Atomico pointed out that today’s value of the European tech ecosystem is 5x greater than that in 2015.

5. Market contraction started at later stage and trickles down to early stage

For rounds of $20 million or higher, the total capital invested was up 62% in Q1 2022 compared to the same period 2021, the downturn really took effect in Q2 with a decline in total capital invested of 26% versus Q2 2021. Q3 2022 is even more bleak, with total investment down 48% compared to Q3 2021.

For rounds of $20 million or less, the total capital invested was still up in Q1 and Q2 of this year compared to the same period last year, but Q3 is down 5% versus the equivalent period of 2021.

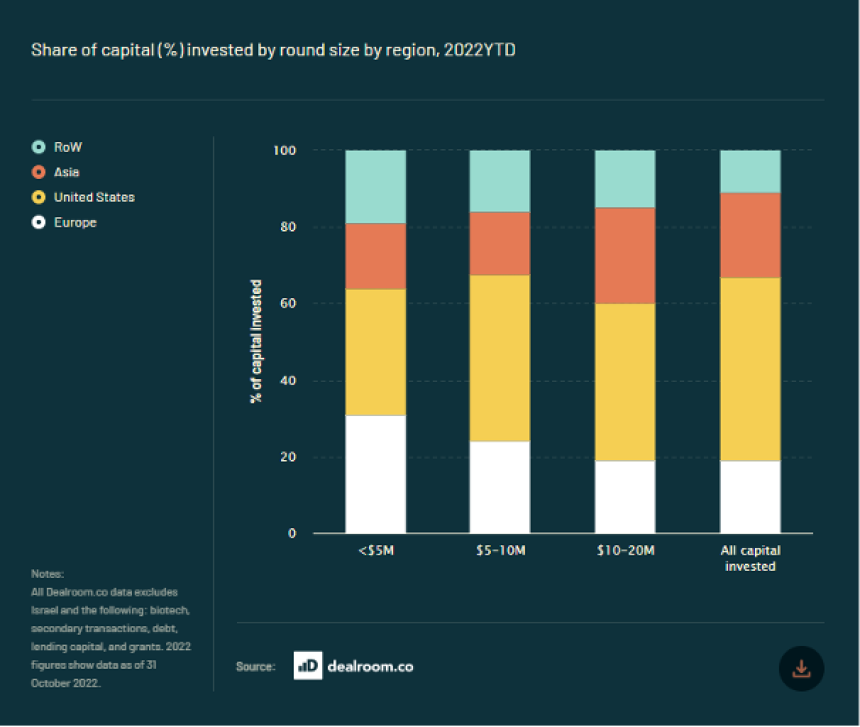

6. Europe’s startup pipeline is at par with the US

Early stage funding is a leading indicator of future growth and Europe's early-stage ecosystem is on par with the US. European startups account for 31% of all capital invested globally in rounds of up to $5M, compared to 33% for the US.